Primary debt capital market auctions- how relevant for volatile markets?

During our demonstrations to Issuers, Investors and Underwriters over recent weeks, the meetings have often concluded with a particularly thoughtful question to us

Is the BondAuction® platform more relevant for strong market conditions? Or is it better in volatile markets?

The growth in fixed income markets has been strong since 2010 with a low interest rate environment and extensive quantitative easing (QE) programmes lending significant support. 2022 has seen disruption to this trend with inflation, quantitative tightening (QT) and geopolitical risks combining to create somewhat of a “perfect storm” for fixed income markets.

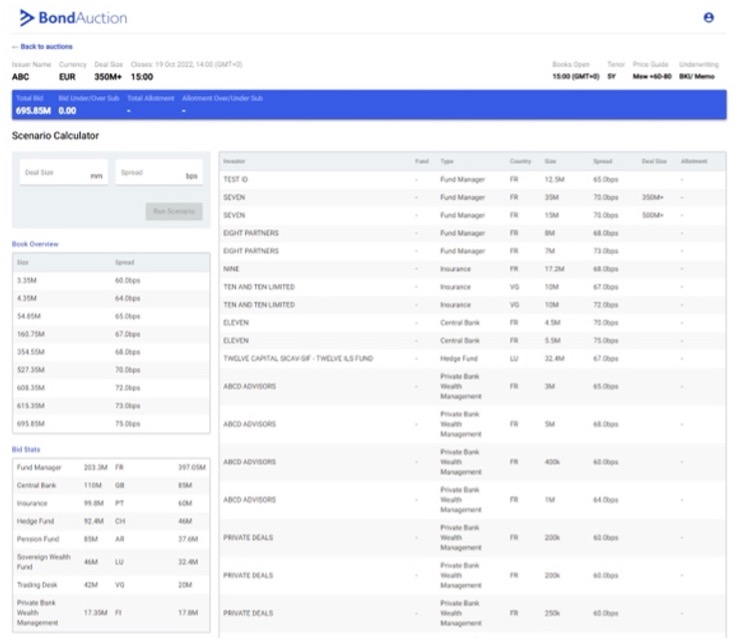

The traditional route to primary markets is through a book-build process that allows issuers to build momentum and tighten pricing, creating FOMO and pushing some investors to a level they may not have otherwise found comfortable. The power of momentum on pricing also assumes that all investors are equally able to reflect to syndicate desks where they care in a deal. With orderbooks of typically several hundred lines the manual processes largely being used today, and lack of transparency in the books, make it practically impossible for Issuers and Underwriters to understand the real appetite of the investors.

In strong markets, the ability for issuers and underwriters to see the price sensitivity of every bid in an auction is likely to outweigh the benefits from “orderbook momentum” for many issues. In tough markets, as many issuers have found in recent weeks where deals have printed at higher than usual new issue concessions; the combination of a lack of orderbook momentum (given the market expectation of regular commentary on the state of orderbooks), and the inability to distinguish which orders are most aggressive/least price sensitive becomes particularly painful.

Syndicate managers have witnessed many deals over the years where it was felt that there was a deal to be done for an issuer, and yet the lack of momentum ended up scaring away the most aggressive orders. In the BondAuction® process, where all successful bidders receive bonds at the clearing level and where no commentary is given to the market on the state of bids during the auction, there is no longer a disincentive to for an investor to show their true demand. We believe capital formation is significantly enhanced through this additional “tool in the toolbox” for issuers and underwriters.

With significant issuer support for our product from recent demos, BondAuction® is looking forward to providing this tool for market participants in the coming months. Please join the conversation!